Ways to Play

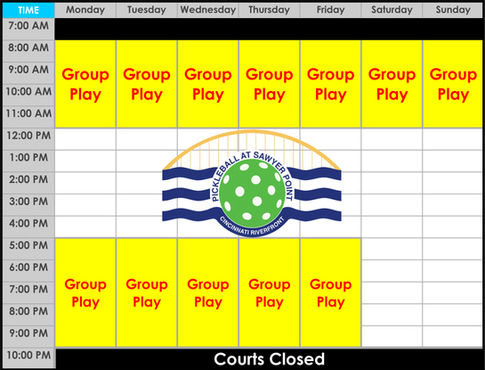

Open Play Schedule

Open Play is our most popular way to play!

Courts are open 8-10 daily March-November

ways to play

Open Play Courts

Courts 1 - 14

-

South Courts for Levels 1.0 - 3.0

-

North Courts for Levels 3.5+

-

For individual(s) who want to mix in

-

Use Paddle Organizer at the base of the stands to rotate into games

-

Winners split & 2 new players join (unless high usage dictates 4 on / 4 off)

-

Maximum of 2 games

Group Play Courts

Courts 19 - 22

-

For people who come to play together

-

Place paddles in rack behind each court

-

Players yield court after each game

-

Doubles or Singles allowed

-

Tennis has priority starting on TC1

-

Tennis yields court after 1 hour session

-

Group Play courts may be limited at times due to League Play

.jpg)

Pickleball @ Sawyer Point Member leagues

We offer four incremental skill level leagues open to our Members:

Beginner Games - Wednesdays @ 11:00am / On-going / $8 per session (opt in)

2.5+ Learning League - Wednesdays @ 9:00am / 6 weeks / $60

Co-ed 2.5+ Ladder League / Mondays @ 7:00pm / 6 weeks / $45

Co-ed 3.5+ Ladder League / Tuesdays @ 7:00pm / 6 weeks / $45